Assemble Expected Documents to possess a good DACA Home loan

Qualified borrowers try not to has an income that’s more 80% of your own area’s median income. To locate your limitation, make use of the Fannie mae map .

- Possess a social Cover number otherwise Personal Taxpayer Character Count

- Have to have most recent immigrant updates reported owing to a position confirmation, Eco-friendly Credit, work visa, or any other qualifying file

- Meet basic earnings and you can a career standards you to affect all the consumers (earn 80% or a reduced amount of your area’s median earnings)

Conventional Money

A conventional mortgage is considered the most well-known kind of mortgage, but it will likely be more difficult to own DACA recipients so you’re able to be eligible for. For every single bank features its own requirements, although lowest downpayment to your a traditional financing is oftentimes 5%-greater than one other apps with this listing.

Minimal credit history for a conventional mortgage was 620, coincidentally greater than other kinds of mortgage loans. To your also top, interest rates and you will mortgage insurance premiums usually are straight down getting old-fashioned funds compared to almost every other mortgage applications.

Home buying Techniques for DACA Receiver

When you find yourself a great DACA individual thinking of buying property, make use of the following suggestions because a guide toward real estate procedure.

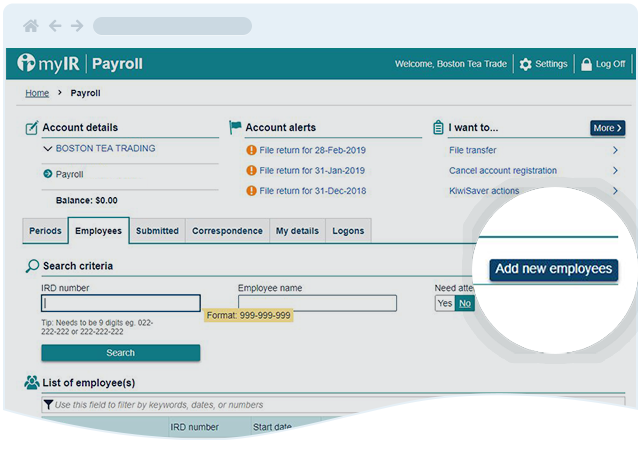

- Proof DACA updates: This could become the A job Agreement File (EAD), that’s approved because of the United states Citizenship and you can Immigration Attributes.

- Evidence of personality: A license could be needed seriously to verify their term.

- Lender statements: Very lenders will require that you render financial comments out-of recent months.

- A job recommendations: You may have to render evidence of a job, such a wages stub or providers page appearing your current work.

- Tax statements: While worry about-functioning, you may have to provide couple of years of taxation statements to help you put on display your providers money.

Determine Your financial allowance

Before finding a house, you ought to determine the restriction monthly property percentage. This may become their financial, property taxes, and you can home insurance. Having you to definitely amount allows you to work out how much domestic you really can afford.

It’s also advisable to reason for month-to-month restoration costs and you can electricity charges, which can be higher than everything you already pay due to the fact a good tenant.

Get a hold of a qualified Agent

Immediately following choosing your allowance, you can look for a real estate agent so you’re able to begin the house searching procedure. You should interviews multiple realtors to find one which knows your position.

Essentially, you need to select a representative that looked after DACA receiver in earlier times and certainly will lead you to just the right household to order system.

Search for Home You are Preapproved To possess

Delivering preapproved to have a home loan mode a loan provider tend to make certain exactly how far money your qualify for. Next, you could start doing your research for a home having a much better knowledge of simply how much you really can afford.

With preapproval makes it simpler to get your promote recognized because provider has no to worry that you will be denied of the a loan provider.

Make an offer and get an examination Complete

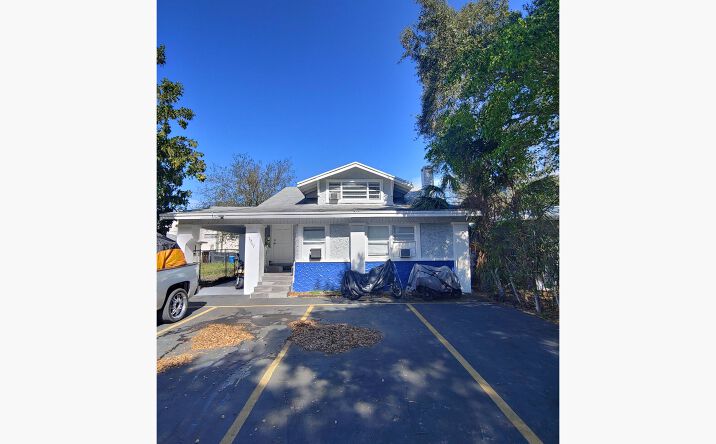

When you discover your ideal household, it is the right time to generate a deal. If the recognized, you need to agenda a home examination to choose people big difficulties that will nix the offer or need repairs before transferring.

Inspections are often elective, but they’ve been the best way to prevent any unexpected situations before buying property. If you discover significant issues, you could potentially inquire owner to advance cash Huntsville Alabama solve them ahead of closure.

Intimate on your own Household and you can Move in

Closing normally happen from the 30 days after recognizing the deal. During the closing, you have to make the newest down-payment, and you will receive any relevant closure credits on the vendor otherwise bank.