first Day Advantage 6000 and Fold 5000

If the Maryland attracts you to own homeownership, after that your decision is generally best. Full Financial is here now to guide you so you’re able to homeownership about Totally free State.All of us of masters has actually manage the newest detail by detail details of the fresh some s. Whether or not it’s your earliest domestic otherwise an improve to the current house, we’ve got your safeguarded. Bid farewell to large interest rates and good morning into extremely reasonable mortgage costs into the Maryland of the additional loan providers. Together, why don’t we transform your ideal of domiciling towards the a wonderful reality. Call us today!

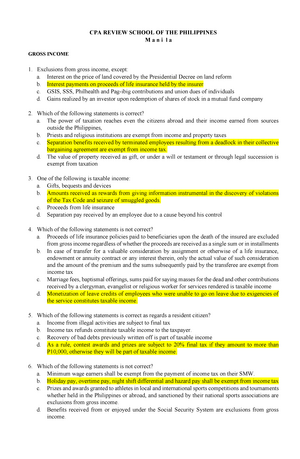

(MMP) first Time Virtue

Maryland basic-day homebuyers score an advantageous 30-season fixed-rates home mortgage system referred to as 1st Go out Virtue out of brand new ent. Tight money limits ranging from $124,500 to $210,980 apply based venue and you can household size. Financial restrictions plus cause for, spanning regarding $472,030 so you’re able to $726,2 hundred. The first-time homebuyer software in Maryland is also enhance this type of money; but not, they can’t end up being paired with home loan borrowing from the bank certificates.

MMP Fold loans

The fresh new Bend finance reflect initially Virtue however loan places Eclectic, enable it to be repeat homeowners also. These finance bring a downpayment and you can closure pricing aid courtesy a good deferred financing.

Maryland SmartBuy step 3.0

For these strained having education loan loans exceeding $step one,000, Maryland’s unique SmartBuy step 3.0 could help reduce that obligation likewise with acquiring a mortgage. The application form lets using doing 15% of your cost otherwise $20,000 restriction to the student loan payment as an interest-100 % free forgiven mortgage immediately after 5 years. In order to be eligible for the first-go out client apps when you look at the MD, your order need to completely pay-off the brand new borrower’s student education loans while satisfying every criteria.

HomeAbility

New HomeAbility system includes several financing getting homeowners otherwise its household participants managing disabilities. A primary 95% home loan of the purchase price next to a zero-focus secondary loan talks about twenty five% of pricing around $45,000 to own downpayment and settlement costs. This type of supplementary lien payments waive during the original financial but are payable entirely in case the property sells, refinances, or ownership transfers in advance of satisfying their identity. Candidates need to have evidence of their disability and you may earn below 80% of your area’s average earnings to qualify for HomeAbility.

The very first time Virtue 6000 package gets $6000 to have down-payment and you can closure fees, additionally the Fold 5000 plan gets $5000 to fund such costs. Second financial is the term always establish these finance. Only when your first mortgage is repaid do you realy start spending it no-notice next mortgage. This can be in the event that financial try paid in whole otherwise after you promote your house otherwise re-finance it after. This is certainly referred to as required payback big date.

This type of s additionally include an excellent ‘partner match’ supply. Assume you really have obtained deposit help from most other tips, instance a manager, gives of community groups, family builders, or the local regulators. In this case, this type of software usually match financial guidelines via an additional attention-free next loan. Believe and therefore groups on this number will in all probability you for the buying a home.

initially Big date Virtue 3% and Fold step 3%

1st Day Advantage step 3% and Fold 3% No percent, second home loan (equivalent to step three% of one’s first mortgage) as the DPA; because deferred liens and you can deposit partner matches, speaking of similar to 1st Date Virtue 6000 and Bend 5000. very first Time Virtue 4% and you may 5% also provides DPA if you are qualified. Maryland brings a beneficial 6% DPA loan.

HomeStart

Maryland offers a half a dozen per cent no-focus DPA mortgage to people at or below fifty% AMI. When the prominent home loan is actually paid off or refinanced, our house is available, otherwise there can be any other kind away from improvement in control, the borrowed funds, that was deferred on the price, becomes completely owed.