step 3. Get a hold of Your Floor Bundle and you will Personalize They

That have Turnkey Services Of Yates House

To get a unique household, whether it’s a modular family otherwise a more conventional stick-built house, means a lot of effort, and is also important to do your homework because very carefully once the it is possible to so that the techniques goes as the effortlessly as you are able to. At Yates Residential property, we strive to make the processes as simple as possible, therefore go out of all of our answer to let direct you as a consequence of it. Lower than, there can be trick information regarding the home financial support techniques: the fresh Yates Belongings self-help guide to financial support.

step 1. Get the Earnings in order

Your specific financial situation have a tendency to determine the amount of money you might mortgage as well as how much money you will see having a deposit, fees, swinging expenses, plus. Its positively critical for a potential resident to evaluate their month-to-month money and you can costs carefully to decide how much cash you could afford to dedicate to your brand new standard home.

While not most of the says require you to seek pre-recognition out of your bank, its a tip to truly get your pre-acceptance files manageable regardless if you are not necessary to manage therefore. Having pre-approval can be utilized as control when creating a bid towards the property, and it also will provide you with an evident advantage on people who carry out not have a letter out of prequalification.

Be sure to ask us from the all of our well-known loan providers for folks who require: we can render a list on precisely how to pick from. I and handle the providing and other legwork into condition to really make the procedure as facile as it is possible.

Pre-Acceptance and you may Pre-Degree

Pre-degree was attained by submission general details about oneself as well as your finances to your lender. Based on you to definitely recommendations, the bank often material a great pre-qualification loan amount (that isn’t guaranteed) to acquire an idea of what you are planning have the ability to afford. The crucial thing to not error pre-degree to own a letter out of acceptance to have a certain amount borrowed.

With pre-acceptance, your submit more descriptive information with the financial-also W-2s, financial statements, and you can pay stubs-and you will pay money for a credit file. When your bank studies your credit report, they are going to like to offer you a specific rate of interest for the loan including a reality-in-financing report. That it declaration traces the specific cost of the loan and you may just what might be required to romantic the acquisition. With pre-approval, you know exactly what your lender will perform to possess your, and rest assured that the loan might possibly be in a position when it comes time.

2. Favor Where you are

The scale, contour, topography, and you will electricity considerations nearby your house all are necessary for believe. Yates Homes can perform assisting you come across result in Pittsylvania Condition, Va, however, i encourage talking to a real estate agent to find only the best assets about venue you need. Whether your assets requires webpages advancements, along with belongings preparing, clearing, highway cutting, paving, really and you will septic, base works, etc.: Yates Property can handle it-all since the a course A contractor, helping you save time, challenge, and cash.

Zoning

We encourage that speak to your local authorities-whether it is at the urban area, condition, and/otherwise county height-to ascertain what zoning ordinances will apply to people possessions you’re thinking about and find out if or not you might create the sort of house you want here just before investing get.

Easements

For those who need certainly to push across the a surrounding package to get into your home, try to get an easement. We advice you can see away who americash loans Carrollton preserves the newest courses and just what their prorata express might cost to have servicing. In addition try to determine what liberties your locals would need to cross your homes and even in the event the limitations is actually certainly noted. Acquiring name insurance rates tend to disclose easements and you may limiting covenants otherwise criteria. You may even must order a study of one’s property.

Tools

All this new residence’s utilities need to be experienced: social sewer otherwise septic program? societal water or better? Can there be a city strength seller? Exactly how higher is the water-table? Is the crushed primarily stone? Were there communication qualities providers in the region for telephone, Television, Internet sites, etc.? It is vital to enjoys an idea for all your utilities before you could go ahead.

Appraisal

Its informed that you receive a different assessment for the a possessions before you could agree on a cost into the seller, particularly if you may be expenses bucks. When you’re financial support the fresh new property get using a loan provider, the lender requires an assessment in advance of giving acceptance.

After you’ve noticed all parameters regarding funding, assets concerns, etc., you ought to head to and you will trip all of our design land and you may meet with all of our specialist specialists to search for the best floors plan for your along with your assets plus the selection and you can adjustment your are able. Yet, we’ll present a quotation which can mirror the latest approximate cost of your brand-new house.

Put, Assets Check, & Protected Framework Quotes

After you’ve established the region where we will help make your new modular house and you also build in initial deposit, a house examination is performed to choose simply how much belongings improvement really works may be needed to secure firm structure estimates. Once this the main procedure is beyond just how, we will be able to present a last quote that have genuine costs for the modular household.

4. Framework

When you conduct their floors package, concept, and you may choice and you may receive mortgage approval, we submit the new preparations to suit your the fresh new standard home to our very own factory. Just like the facility is creating the latest areas of your new household, we shall strive to get ready the brand new land to have design, pour footers, and create your own foundation otherwise cellar structure. Home having basement generally have these types of flooring stream pursuing the family was produced.

Immediately following your modular house is built on its base, we complete all external siding and/or stone really works, hook the utilities and plumbing, then finish the required work on your driveway and the sidewalk resulting in your front-porch. The past tips should be levels your own lawn, plant grass, and you will done their land.

5. Closure regarding Offer

Once your the standard house is done, i safer the latest monitors to ensure your household receives a certification away from Occupancy. When this certificate is actually acquired, i consider your contract closed, and you’re prepared to move into the new custom modular family!

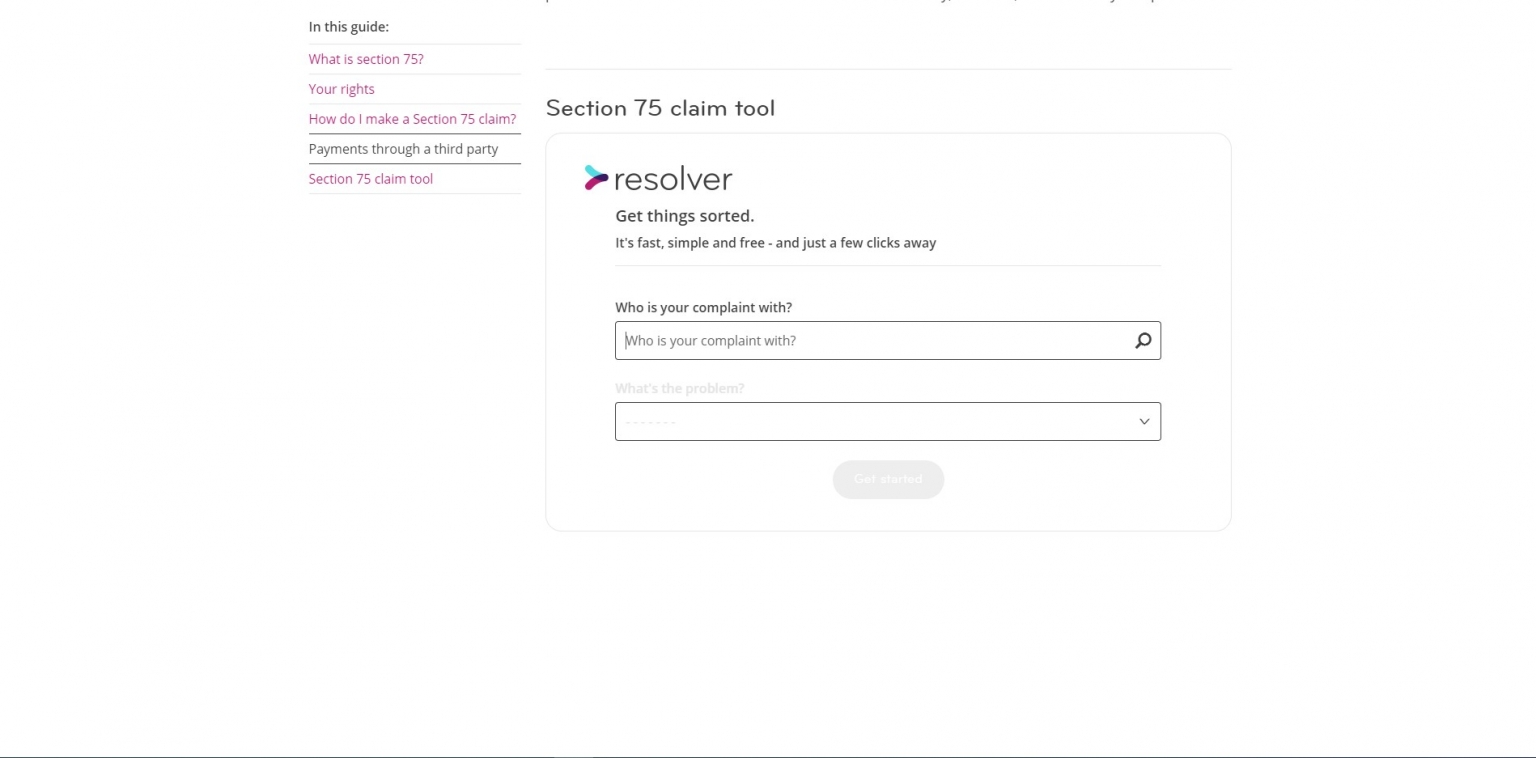

Score Pre-Eligible for a standard Financial

When you’re prepared to begin the credit processes, simply fill out the brand new short mode below plus one of our capital pros will be in contact immediately. Fields marked that have an asterisk * are needed.