?? Jeopardizing your credit score inside the buying process

“Your own home loan elite group will ensure you find the house or apartment with financing product that provides the welfare rate and you may words so the percentage try safe,” Peters saysmitting to better monthly payments outside of the family members’ funds is actually where many somebody make a major mistake.

Your credit score is a vital economic element of your house to buy techniques all the time. A lender will run a credit history to greatly help dictate the brand new mortgage matter you are pre-acknowledged to own, nevertheless cannot stop indeed there. Before you can personal to your home, your credit score would be removed again to be certain things are manageable and the sales is proceed given that organized. Therefore, keeping a good credit score is actually very important. Along with, it is best to prevent opening otherwise closure bank accounts, making payday loans Pennsylvania an application for brand new playing cards and and then make any highest purchases throughout this era.

?? Ignoring your local

While you have discovered our home, hold the whole people at heart through your research. You can redesign and you can change a house, however are unable to alter the neighborhood or place. Check out the type of people your enjoy, this new residence’s area as well as proximity into works, colleges and you will places. It’s also advisable to think regarding resale really worth whenever viewing functions.

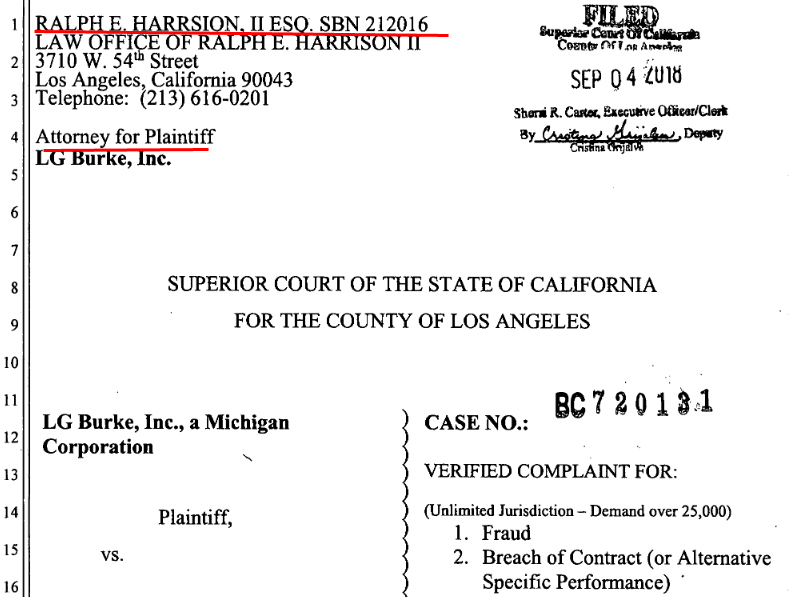

?? No longer working with a decent home lawyer

Certain states require a bona fide estate attorneys to complete the order, whereby its smart to-do their research and you may select correct one. Keep in mind that this is certainly an additional cost. “Their home attorney’s character is very important, because they negotiate the primary regards to the latest package and include conditions that will cover your in the get process,” Peters demonstrates to you. That is one other reason as to why dealing with a knowledgeable a property broker is very important, as they can strongly recommend a reliable a residential property attorney to become listed on the cluster.

?? Failing woefully to look loan types

Anybody tend to envision good 20% down-payment towards the a home ‘s the fundamental. not, that is not fundamentally the truth, specifically if you is a first-go out homebuyer. You will find FHA loans, which permit you to establish only step three.5% for people who see particular economic conditions. There are even Virtual assistant financing that don’t wanted a down payment to have veterans, and you will USDA financing from Agency away from Agriculture that do not telephone call having a downpayment for the functions within certain specific areas. You could make use of certain first-big date homebuyer apps, whether they was government, condition or company-created.

?? Are unaware in regards to the upfront will set you back

Get advised concerning the initial will set you back doing work in purchasing your first house. The worst thing need is actually surprises along the way. Ask your real estate professional having a listing of will cost you in order to anticipate from inside the processes as well as when you find the home. Also the downpayment, there are more costs like a house review or good a home attorney’s fee.

?? Taking on your offers

Purchasing your very first house is more than likely the greatest purchase you have available, however, taking up your discounts to close off the offer is maybe not wise. Unexpected expenses develop also long afterwards your intimate towards assets. When you are transitioning out of a little business flat, furnishing your new family could be expensive. Otherwise, if you have never ever had an outdoor and get one to, maintenance and you can brand new devices requires a lot more orders. On top of that, it is as well as where a home assessment comes in – it offers an idea of the cost to exchange or ree to have whenever the individuals financial investments will be required.