Will you be Behind Into the Mortgage repayments Which have Cenlar FSB?

Will you be at the rear of towards the mortgage repayments and are usually are foreclosed on by Cenlar FSB? Deciding just what action you should bring second will be hard, that’s why Denbeaux & Denbeaux Legislation would like to allow it to be easier for you.

Mortgage servicers like Cenlar FSB need adhere to federal statutes regulating the brand new foreclosure processes from inside the New jersey that avoid servicers out-of particular incorrect strategies that break resident rights. Even if you ought to in fact become foreclosed to the by Cenlar FSB, you’ve got choices.

Or no of those or other points has happened for you, legislation office out-of Denbeaux & Denbeaux Rules could possibly let:

- Cenlar FSB announces your in the default and you will threatens foreclosure regardless if youre up-to-time on your own home loan payments

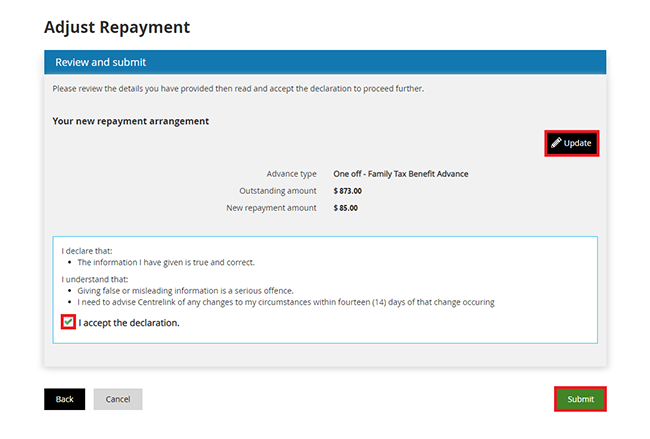

- Cenlar FSB will not honor otherwise comment the loan amendment

- Cenlar FSB denies a loan amendment

- Cenlar FSB refuses to deal with a home loan percentage otherwise reinstatement

- Cenlar FSB pursues a foreclosure otherwise sheriff sales if you’re the loan modification software is nevertheless are assessed

Talking about Cenlar FSB are tiring. Definitely keeps an experienced foreclosure safety lawyer by the top that will navigate you from the procedure and provide you with a good options within getting a good benefit.

Who is Cenlar FSB? Why are They Foreclosing On my House?

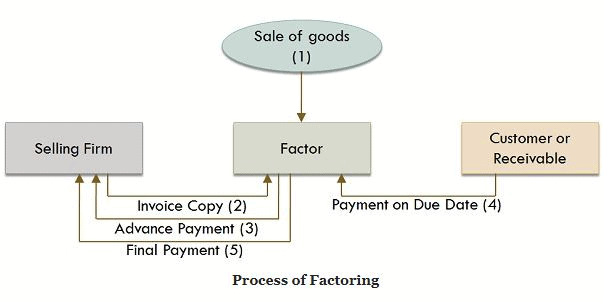

Home financing maintenance providers, labeled as the loan servicer, is the providers you to definitely protects your real estate loan and often gets confused with the owner of the borrowed funds.

The owner of their mortgage is the financial otherwise mortgage business that in the first place offered you the home mortgage you to definitely allowed you to purchase your assets. Specific people will also be the loan servicer of the mortgage, however some owners hire the next party to act given that servicer of your financing.

If you have obtained a notice out of Purpose in order to Foreclose or almost every other sees of Cenlar FSB, they could or may well not own the mortgage. But not, failing to operate when you receive a notice out of foreclosure out-of Cenlar FSB instantly can result in a foreclosure inside only a small amount given that six months.

Quite often, this new property foreclosure process will be date sensitive and want you to property owners correspond with their servicers as fast as possible to help you get the very best overall performance. It’s important to understand whom your financial repair business is of first so you know who to reach americash loans Placerville over to to own information concerning your foreclosures and you will loan mod alternatives.

Citizen Legal rights In the Foreclosure

- Issue the fresh new property foreclosure

- Property foreclosure mediation

- Losings minimization

- Awake-to-day on mortgage repayments

Banks and you may financial servicers is actually notorious to make errors you to break the law plus liberties. This type of abuses could lead to monetary settlement and you can/otherwise power to have property owners however, tend to get swept under the rug.

When the Cenlar FSB is actually incorrectly stating which you overlooked costs, perhaps not truthfully chatting with you, or doubt you mortgage loan modification attributes, contact us now. They might be breaking the homeowner liberties. By firmly taking the best procedures along with the correct courtroom sign, you could potentially include your liberties along with your domestic.

Lawyer You to definitely Portray Banking institutions or Servicers Into the New jersey Property foreclosure

If you’ve been prosecuted because of the Cenlar FSB or other financial or servicer by the one among them lawyer otherwise attorneys, get in touch with Denbeaux & Denbeaux today to find out more about the options to battle against foreclosures on your family.

We provide 100 % free 1st services to learn about the choices for loans cover. If you have been charged to have a loans contact us to possess an effective 100 % free instance testing and to correspond with all of our debt safety attorney, Josh Denbeaux.